Veritas Finance

Veritas Finance focuses on meeting the financial needs of micro, small and medium enterprises, which have remained largely underserved. Although MSMEs are the backbone for Indian economy, contributing greatly to livelihood creation particularly in rural communities, they continue deal with poor support infrastructure, inadequate market linkages, lack of adequate and timely financing sources and which leads to an overwhelming reliance on informal sources of lending

Veritas Finance focuses on meeting the financial needs of micro, small and medium enterprises, which have remained largely underserved. Although MSMEs are the backbone for Indian economy, contributing greatly to livelihood creation particularly in rural communities, they continue deal with poor support infrastructure, inadequate market linkages, lack of adequate and timely financing sources and which leads to an overwhelming reliance on informal sources of lending

Lok has co-designed an unsecured working capital (WC) product with Veritas that provides credit access to micro businesses in urban areas, whose key source of funding is still the local money lender. Typically these customers are local grocery operators (kirana stores), small restaurant operators, and other small vendors. While there is huge demand in this segment, Veritas founder, D. Arulmany, was always keen on building this differently. His vision has been to create a product that mirrors the behavior and cash flow of the customer rather than force-fitting a traditional loan structure. Piloted in mid-2016, the product operates on the fulcrum of daily collections and short-duration, repeatable loans. Today, the WC product has crossed 6500+ active customers. Lok has been excited to partner with Veritas on this product, given its innovative nature and potential to greatly impact the lives of the borrowers.

Monitoring Collections:

Monitoring Collections:

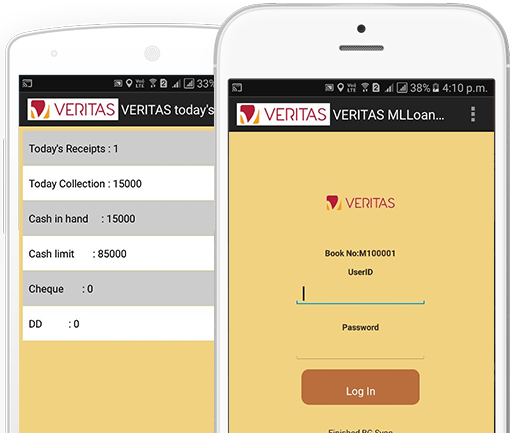

While the collections are done manually, the recording of payment, receipting & reporting has been automated in Stage 1 of the project. Lok, through its Technical Assistance Program, co-sponsored the development of the customized collection app. The app is currently used across all working capital branch locations by 60+ collection executives, to record customer-wise collections on a real time basis. The customers get an auto-generates SMS confirming the payment.

Sales force and work flow automation software:

The objective of this module is to move the entire sourcing and credit process of the WC product online. This will enable the Veritas field staff to make on the spot go/no-go screening, and reduce turn-around-time from the current 3 days to a few hours. Lok was instrumental in identifying the vendor to develop this application. The product is in beta and expected to go live in the next few months.

"Access to finance for micro enterprises and small businesses from semi urban and rural areas continues to remain a distant dream despite initiatives by many organizations. Veritas Finance, with a vision to bridge this gap, offers suite of products that are designed to meet various financial needs such as working capital, business expansion and asset creation, of this underserved self-employed segment

Partnership with Lok has made Veritas make a pioneering effort in designing and offering a working capital loan product as an sustainable alternative to free the self-employed segment from the clutches of moneylenders. With technical assistance from Lok's Foundation arm, Veritas Finance has been able to deploy cutting-edge technology for not only to improve the operating controls but also in enhancing the customer experience through the mobile platform.

Veritas Finance is privileged to have partnered with Lok Capital, who knows the challenges of financial inclusion better than most in the sector, understands the significance of execution capabilities and shares the grit and determination to stay actively focused on creating a long term impact through financial intervention in this MSME segment."

Has 6500+ Active MSME Customers

Used across 11 branches