Company Overview: Veritas focuses primarily on providing medium-and long-term credit to micro enterprises. Typical customers of Veritas-small and micro entrepreneurs who run bakeries, restaurants and provision stores-have monthly incomes ranging from Rs. 25,000 to Rs. 60,000, with no prior exposure to formal business finance. MSMEs today deal with poor support infrastructure, inadequate market linkages, lack of adequate and timely financing sources and end up relying overwhelmingly on informal sources of lending. By investing in companies like Veritas that provide this support and most importantly safe and timely financing, Lok promotes organization of a sector that is critical in meeting national objectives of generating employment, improving livelihoods.

Company Overview: Mintifi enables financing to MSMEs (micro to small and medium enterprises) by leveraging technology to aggregate and utilize operational data as a key part of the credit underwriting process. There is a large and unmet demand in for debt financing for the upwards of 29 MN MSMEs operating in India. While traditional lenders face steep challenges in servicing this segment, from heavy sourcing costs to subjective credit assessments, Mintifi is bridging the gap; fostering innovative partnerships to drive financial inclusion in the MSME space.

Company Overview: Ummeed is a Delhi based affordable housing company providing home loans to lower and middle income Indian families. Ummeed helps people with informal incomes, those who have limited access to organized finance and who also constitute significant portion of the Indian population. Lok's follow-on investment in Ummeed will be used for further expansion into north and central India and an expansion of technology. According to founder Ashutosh Sharma, "traditional credit models are not specifically made for affordable housing finance" and this is where technology can play a role to better address this underserved segment.

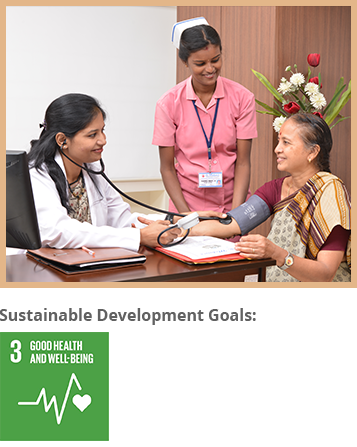

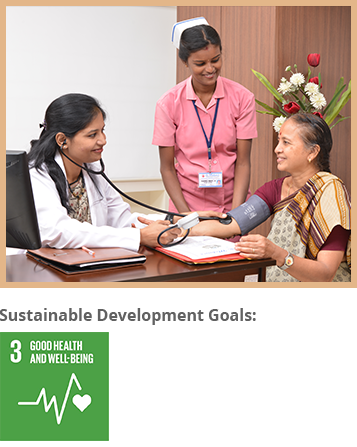

Company Overview: The International Diabetes Federation (IDF) estimates that India will become the diabetes capital of the world with the number of cases of diabetes expected to cross 100 million by 2030, from about 70 million today. Dr. Mohan's is one of the earliest organised players in the diabetes care market in India having setup 34 centres across seven states in India. Dr. Mohan's takes a holistic approach to diabetes care from prevention to treatment with the vision to provide high quality & comprehensive diabetes care across geographies and income segments throughout India. Lok's investment represents the first institutional capital taken by Dr. Mohan's in its quarter century plus of operations.

Company Overview: Suryoday is a Mumbai based Small Finance Bank providing financial services to 750,000+ low-income customers. Originally a microfinance insitution, Suryoday went live as a small finance bank (SFB) in January 2017. Lok played a key role in the successful transformation to a small finance bank, which Suryoday touts as a: "small step in banking but a big step in social inclusion". Lok managing partner, Venky Natarajan, headed the SFB transformation committee. Led by Mr. R. Baskar Babu, Suryoday's main endeavor is to bring the best banking solutions to the 'banked', 'under-banked' and the 'un-banked' sections of the society.